Therefore, the SML continues in a straight line whether beta is positive or negative. The assets above the line are undervalued because for a given amount of risk (beta), they yield a higher return. Since we only sampled 50 of the data (via the Percent data edit box above), results should. The function should return a spectopo.m plot (below). This will pop up the popspectopo.m window (below). Why SML is a straight line?Īll the correctly priced securities are plotted on the SML. To plot the channel spectra and associated topographical maps, select Plot Channel spectra and maps. A negative-beta asset requires an unusually low expected return because when it is added to a well-diversified portfolio, it reduces the overall portfolio risk.

:max_bytes(150000):strip_icc()/GettyImages-471328958-34d0335970734ef487572a2330c6c6aa.jpg)

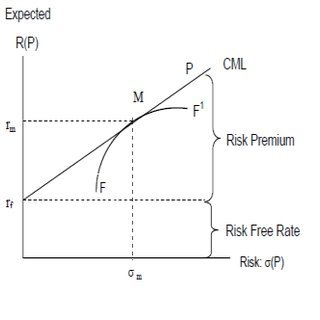

Interpret the CAPM, II When the covariance is negative, the beta is negative and the expected return is lower than the risk-free rate. Beta is used in the capital asset pricing model (CAPM), which describes the relationship between systematic risk and expected return for assets (usually stocks). Stocks that fall below the line are a poor risk, according to the SML theory.īeta is a measure of the volatility-or systematic risk-of a security or portfolio compared to the market as a whole. Foam plot above it, and Repo Men plots below it. Stocks that are above the line constitute a good risk. The t-bills and market portfolio plot on the SML, Alta Inds. Click “Line” in the Graph section you will see your Security Market Line. Highlight cells D2 through D4 and then click on the “Insert” tab. The y-intercept of this line is the risk-free rate (the ROI of an investment with beta value of 0), and the slope is the premium that the market charges for risk. The Security Market Line: This is an example of a security market line graphed. Fundamental analysts use the CAPM as a way to spot risk premiums, examine corporate financing decisions, spot undervalued investment opportunities and compare companies across different sectors. 1 Synopsis 2 Plot 3 Characters 4 Trivia 4. How do you read SML?Īny security plotted above the SML is interpreted as undervalued. 'Bowsers Cookies' is the 16th episode of SML Movies. A security plotted above the security market line is considered undervalued and one that is below SML is overvalued. SML is a graphical depiction of the CAPM and plots risks relative to expected returns. The CAPM is a formula that yields expected return. Any investment can be viewed in terms of risks and return.

0 kommentar(er)

0 kommentar(er)